Fort Lauderdale Bankruptcy Lawyer

A DIFFERENT KIND OF LAW FIRM: QUALITY, COMPASSION & CARE

If you are drowning in debt, bankruptcy can be your lifeline. You don’t have to carry the stress of debt any longer. Through bankruptcy, you may be able to:

- Halt creditor harassment

- Wipe away debts

- Stop wage garnishment

- Rebuild your credit

- Achieve a fresh start

- Stop foreclosure

- Keep your car

If you are stuck with insurmountable debt, you may think considering bankruptcy means giving up. Nothing could be farther from the truth. Filing a Chapter 13 or Chapter 7 bankruptcy may be a way to wipe the slate clean. It can be a pathway toward fresh beginnings and renewed financial health.

OUR MISSION IS TO HELP YOU ATTAIN FINANCIAL STABILITY

At the Bankruptcy Law Firm of Clare Casas in Fort Lauderdale, Florida, we understand the stress that accompanies this difficult decision. We provide compassionate representation to help clients achieve financial freedom.

We firmly believe that pursuing bankruptcy or financial help should not be an unpleasant experience. Rather, it should be a positive one — after all, you are turning your life around and embarking on a new path. To that end, we value building trust with each client to make sure he or she feels comfortable and confident throughout the process.

We offer free initial consultations. Because we believe money should not be a barrier to saving your home or getting rid of credit card debt, we also offer reasonable fees and flexible payment plans.

OUR CLIENTS ARE OUR PRIORITY

At the Bankruptcy Law Firm of Clare Casas, you are not a number. You are a unique individual with a financial situation that deserves the full attention of an attorney — not just support staff. If you are paying attorney rates then you deserve to have a qualified bankruptcy attorney handle your case from start to finish.

Our clients are our highest priority. You may hear other firms say that, but you will witness us delivering courteous, professional service. We will consistently go above and beyond to help you. Your case will be personally assessed, prepared and represented from start to finish by an attorney, not the support staff. You will not be banned from the preferred evening or Saturday appointment slots because they are reserved for “new clients.” We make it a priority to promptly return your phone calls. Our clients always come first.

ATTAINING FINANCIAL HEALTH

You have options. At times it may seem that your situation is hopeless, but rest assured that there are always options available, regardless of the difficulty of your situation.

Bankruptcy is not the only option for achieving financial health. We help clients take advantage of the numerous tools available for financial help and debt relief. If your home is in jeopardy, we can determine whether a loan modification may help you save your home. If you have been relentlessly pursued by creditors, we can help you put a halt to creditor harassment.

Additionally, we can walk you through what life looks like after bankruptcy. You will likely discover that pursuing debt relief options such as bankruptcy will drastically improve your financial health and stability over the long term.

We are committed to helping clients find the best solution for them. We don’t push clients toward filing bankruptcy if doing so isn’t right for them.

OUR FIRM DOES NOT JUST PREPARE PAPERWORK AND KICK YOU OUT THE DOOR

As a small firm, our Fort Lauderdale bankruptcy lawyer and staff will know your name. We take a holistic, relationship-based approach to client service. We will work with you to determine whether bankruptcy or other debt relief solutions fit into the big picture of achieving your long-term goals.

Making a decision. Once you know that you are not at the mercy of your creditors and can stop the creditor abuse, you will get to make a decision about what to do. Your creditors do not get to decide your financial future — you do. But until you get all the facts and information that will help you take control – you will continue to be abused by creditors and their tactics.

But first, you must make a decision on how to proceed. This is not the time to bury your head in the sand and pretend things will magically go away. Unfortunately, the problems we ignore tend to get worse under the “Ostrich Approach” — which is all the more reason that you should take us up on our offer of a free consultation with a bankruptcy lawyer.

Most people find that once they make a decision to take action, they feel better about themselves and their future.

Questions To ask in your search for a bankruptcy attorney:

Your creditors already treat you indifferently and like a number. Should your lawyer treat you that way also?

If you are searching for someone to represent you through a bankruptcy proceeding, here are some things you should observe and ask as you meet with them:

- Did you speak with an actual attorney? Or were you passed off to support staff?

- How much time did the lawyer spend with you talking about the details of your financial situation?

- Was the bankruptcy attorney interested in what you had to say or was he or she just giving you a bankruptcy sales pitch?

- Is the attorney trying to fit you into a Chapter 13 bankruptcy even if you qualify for a Chapter 7, without a compelling reason to do so? What percentage of the attorney’s cases is Chapter 13?

- Have any bar complaints or disciplinary actions been filed against the bankruptcy attorney? You can check the Florida Bar website for this information. This is a very important consideration, and you should take the time to check all lawyers for any disciplinary actions. You want to put your case in the hands of a bankruptcy attorney with a proven track record of ethical and professional behavior. You deserve that much.

- Will the bankruptcy attorney personally prepare your bankruptcy petition or will the important work be passed off to support staff?

- Will the bankruptcy attorney you spoke to attend the 341 meeting of creditors with you or will he or she send someone else?

- If you call with a question, does the attorney take your call or promptly return your call within 24 hours?

- Does the lawyer promptly answer emails?

- Does the attorney regularly offer evening appointments (the most convenient time slots)? Or are these slots reserved only for first-time potential clients?

- Does the Ft. Lauderdale bankruptcy attorney take pride in his or her work and apply an attention to detail?

- Is the loan modification attorney committed to delivering excellent legal services at reasonable prices?

LEARN HOW OUR CORAL SPRINGS CHAPTER 7 AND 13 BANKRUPTCY ATTORNEYS CAN HELP

Isn’t investing an hour of your time worth having peace of mind? Make an appointment today for a free consultation. Find out about your debt relief options, make a decision and start enjoying life again. Take control of your future. We have evening appointments available so you don’t even have to miss work!

To learn more about how we can assist you in achieving financial health and stability, contact our Fort Lauderdale bankruptcy attorney at 954-327-5700.

WHAT YOU CAN EXPECT

During your consultation, we will ask you a few questions to get a better picture of your financial situation. You will find out what options are available to you if you had a lawsuit filed by a credit card company, are in foreclosure, seeking a loan modification or are just unable to pay your credit card debt any longer.

You just have to remember there are always solutions to every financial problem — you may just not be aware of them at this moment. Experience has shown that once people become aware of their options, they leave our office and usually enjoy their first good night’s sleep in a long time.

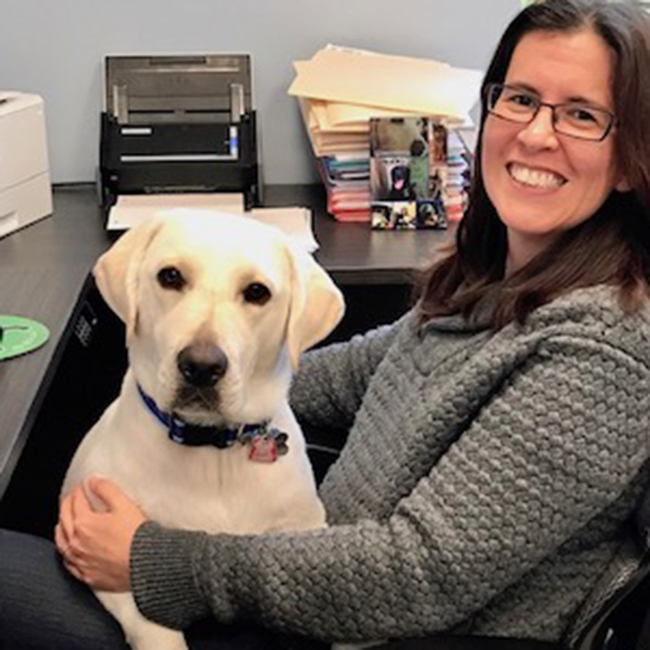

Meet Clare A. Casas

No one ever dreams or aspires to file for bankruptcy or be faced with foreclosure. Life happens, unemployment, salary reductions, forced retirement, divorce, illness or simply increasing costs and stagnant compensation. Part of life is coping with unexpected and...

Client Reviews

Clare and all of her staff are truly amazing. Very thorough and always there for you through this difficult time. I recommend her for your bankruptcy needs. Don't go anywhere else.

Clare and her staff are truly amazing!! My case was prepared and closed in less than 4 months. It was a lot of work, but they helped me through it all. If you need help and guidance Attorney Clare Casas is the number one choice!!

Attorney Clare Casas and her staff were not only professional and effective during my case they were also kind and understanding. If you're considering or need an attorney for financial matters, I highly recommend contacting this office first. You'll be glad you did!

Contact Us

- 1 Free Consultation

- 2 Hablamos Español

- 3 You Are Our Priority

Fill out the contact form or call us at 954-327-5700 to schedule your free consultation.